US beef market update: production falling, as imports face competition

Key points

- US beef production set to fall by 600,000 t from 2022’s levels

- Lower available supplies are driving up prices, making them less internationally competitive

- Australia and New Zealand are capitalising on lower US production through higher imports

- Exports are down from the USA as Australia competes in key Asian markets

Production

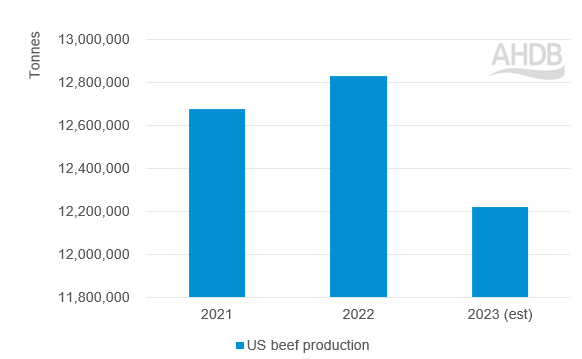

US beef production is set to reach an estimated 12.2 Mt for 2023, a fall of over 600,000 t from 2022. This stems from a fall in slaughter from feedlots, down 5% year on year for July. Production is expected to fall for the remainder of 2023, with lower prime slaughter slightly offset by gains in carcase weights and growth in cull cow slaughter. The USDA forecast that production in 2024 will fall to 11.4 Mt, down 800,000 t (6%) from 2023.

US annual beef production 2021-2023

Source: USDA

Isabelle Shohet

Analyst (Red Meat)

Prices

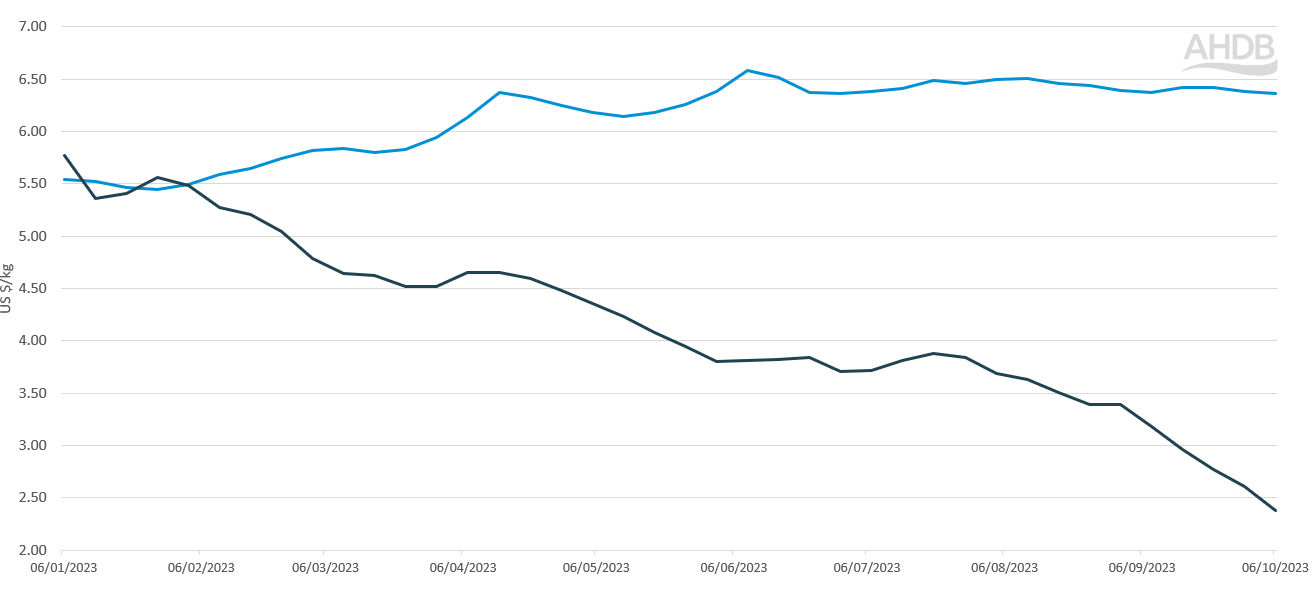

US steer prices have shown growth from the same period last year, as supplies become tighter. Prices have steadied over the past months, sitting at $6.36/kg for the week ending 06 October 2023. For this four-week period, prices averaged $6.40, up from $5/kg for the same period in 2022, growth of 28%.

In comparison, Australia, which ramped up its production throughout 2023, has seen price falls throughout the year so far, allowing Australian imports to be more competitive on the international stage in comparison to the USA.

US and Australian cattle prices Jan–Oct 2023

Source: USDA, MLA

Trading situation

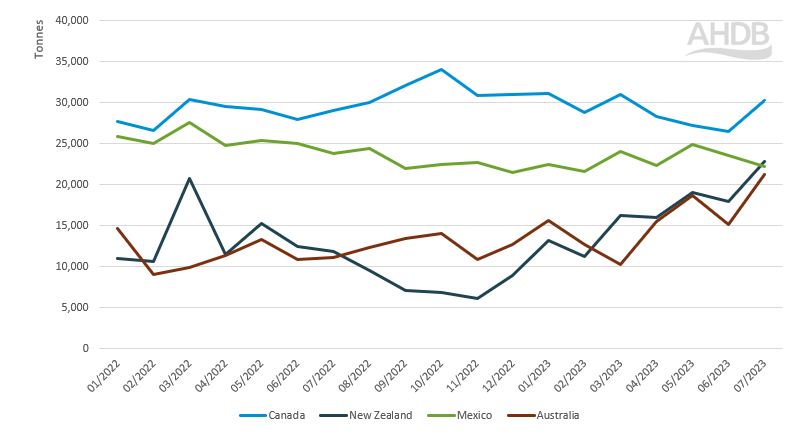

US beef imports totalled 773,000 t for the year to date (Jan–Jul), growth of 3% from 2022. Volumes remained fairly unchanged from Canada, the USA’s largest trading partner by volume, at 203,000 t in 2023 so far.

Meanwhile, imports have grown from New Zealand up to 117,000 t (+25%) and Australia to 110,000 t (+36%). These higher imports have been driven by an expansion in the Australian beef herd, which has dropped prices to be more internationally competitive. AgriHQ notes that New Zealand volumes exported to Japan, Korea and China have fallen by 10% this season. This may have pushed more product onto the US market as a result.

Growth in volumes from Oceania seemingly correlate with growth in frozen product entering the USA. Since January 2023, frozen product has overtaken fresh product as the largest category entering the USA, coinciding with boosted imports from Australia and New Zealand, as frozen product is more suited to longer transportation times.

As Oceania countries have made gains, countries closer to the USA have lost out. Mexico has seen a fall of 9%, down to 161,000 t, as Brazil has seen losses of 12% down to 99,000 t. According to the USDA, the tariff-rate quota (TRQ) for Brazilian beef to enter the USA was filled in early May, meaning any subsequent imports face a significantly higher tariff for entering the USA, hence the drop-off in trade. Read more on our Brazil update here.

United States monthly beef imports 2022-23

Source: US Census Bureau, via Trade Data Monitor LLC

US beef exports totalled 736,000 t in the year so far, a drop of 93,000 t from 2022. Lower domestic supplies and high prices have lowered volumes. Weaker economic conditions in key nations and an unfavourable exchange rate have further limited exports.

The largest fall came in shipments to Japan, down to 146,000 t. Industry reports suggest that Japan has a higher domestic inventory of beef than expected, which may have dampened demand for imports. Volumes have also fallen to South Korea to 147,000 t, as the second-largest market for the USA. Exports to China have also fallen by 17%, to 110,000 t.

What does this mean globally?

As the USA is a large player in the international beef market, global supply and demand are impacted by its falling production and growing prices. Gaps in supply stemming from the USA are being filled by Australia and New Zealand, as their production grows throughout the year. Global demand for beef is expected to be fairly static for the remainder of the year, as consumer demand is hampered by cost-of-living crises, with the USDA expecting Chinese demand to wane in 2024. Demand is, however, expected to make small gains in Brazil, Canada and India for 2024 to counterbalance the decline.

Global prices could be mixed for the remainder of the year, as Australian and Brazilian prices are likely to remain pressured, while US prices are likely to remain firm. These factors will prove an important backdrop for the EU market, and in turn the UK market, with the price competitiveness of imports a key factor to watch.