Big fall in EU pork production recorded, as pork prices also come down

The production figure for January to July was also 10% down on the five-year average. The EU Commission’s latest forecast is for pig meat production in 2023 to end the year down 6.6%.

Production in all key producing countries has fallen year on year, with the largest declines in Germany of 236,000t (-9%), and Denmark down 202,000t (-21%). Volumes in Spain and the Netherlands were down between 143−144,000t from the same time last year, down 5% and 15% respectively.

These drops were driven by large reductions in slaughter levels. EU throughputs totalled 126.1m head in the year to July, with slaughter in key producing countries down similar percentages to production.

Prices

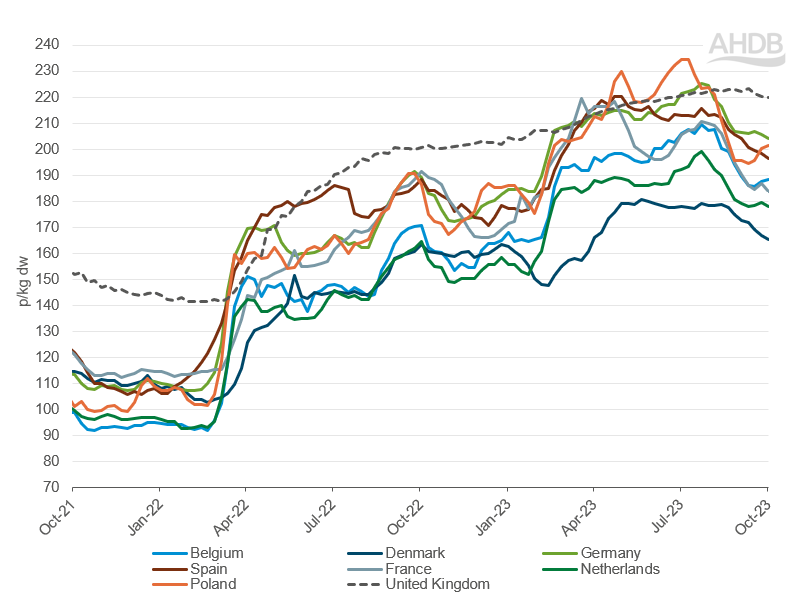

Lower supplies in the EU have led to significant growth in prices across the EU over the past few months over the spring and summer . However, prices have declined from these highs down to an average of 196.4p/kg for the 4 weeks ending October 1, as demand has eased. This is a fall of 5.8p from the previous four-week period, and down nearly 20p from highs seen towards the end of July, with weak demand at home and internationally seen as the main driver.

France has seen the greatest decline from its peak, down by 27p/kg to end October 1 at 183.8p/kg. Weaker declines have been noted in Germany, Spain, the Netherlands and Poland, all down around 20−22p from the peak. Denmark has seen the smallest fall, down 14p but had consistently lower prices to begin with.

The EU reference price fell by a further 2p to 193.8p/kg during the week ended October 8. The gap between the EU and UK references has grown to beyond 25p and could grow wider yet, when the latest EU falls are taken into account.

Last week saw the the German pig price come down by a further 10 euro-cents to stand at €2.10/kg (just over £2/kg), with Belgium down by more than 10c, France by 7c and the Netherlands and Spain by 3-4c. The German sow price was down 11c.

Trade

EU imports of pork totalled 84,000 t in the year to July, a fall of 16,200t, 16%, from the same time last year. This is despite a fall in domestic production, which may have necessitated higher imports to meet demand. This indicates that overall demand for pork in the EU has fallen as consumers face cost of living crises. The European Commission forecasts per capita consumption to drop by 5% in 2023 to 30.4 kg.

Imports from the UK have fallen by over 22,000 t (-27%) to just under 60,000t, as lower UK production has reduced the amount of product available for export, coupled with prices sitting higher than the EU, reducing the competitiveness of product on the market.

However, the UK does remain the most important country for EU imports in terms of volume. As volumes from the UK have fallen, shipments from Switzerland and Chile have grown year-on-year to 11,300 t and 5,000 t respectively. This is growth of 4,500 t for Switzerland and 2,800 t from Chile. The European Commission predicts that pig meat imports may end the year down 20%.

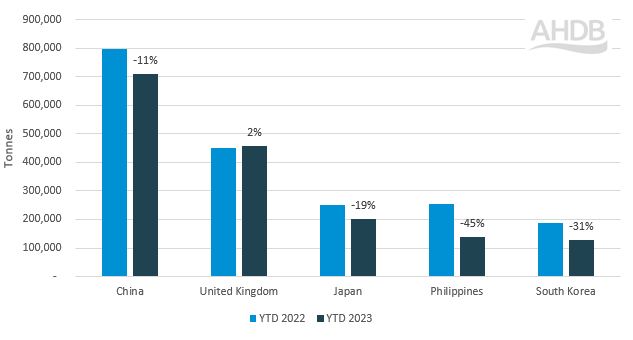

EU export capacity has fallen, in line with reduced production. Current EU forecasts anticipate pigmeat exports to end the year will bw down 16%. Total exports for the year to July were 2.3 Mt, down by 18% from 2.8 Mt in 2022. The vast majority of the fall in exports came from Asian countries, with the Philippines down by 115,000t, China by 85,000t, South Korea by 58,000t and Japan by 49,000t, according to AHDB analyst Isabel Shohet.