EU compound feed market outlook uncertain – FEFAC

The outlook for EU compound feed production in 2024 presents a mixed picture, reflecting varying trends across livestock sectors and influenced by economic, regulatory, and environmental factors, according to a recent press release from FEFAC.

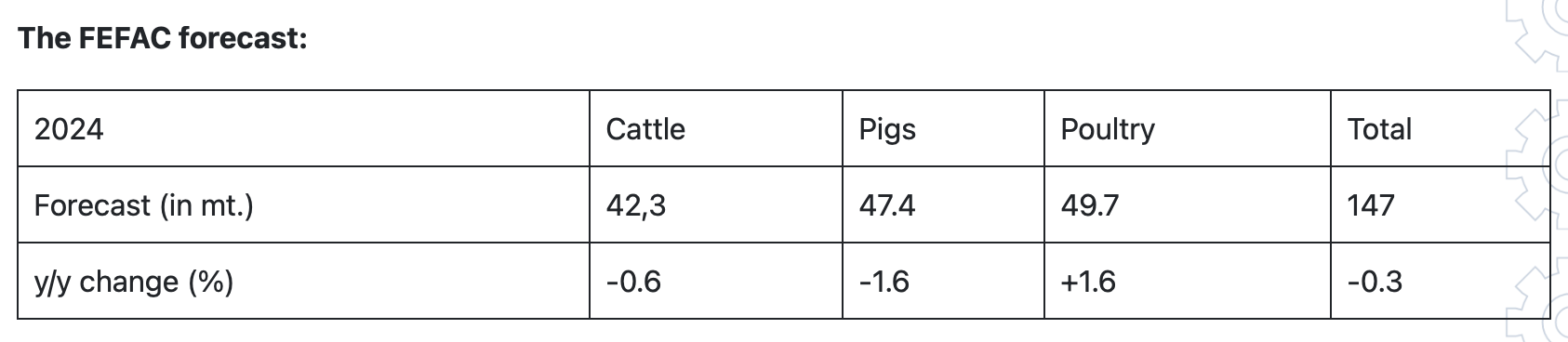

The main market drivers for 2024 include economic uncertainty, regulatory changes, and ongoing environmental and animal welfare policies. These factors will continue to shape production dynamics across the EU, with varied impacts on different animal feed sectors. Based on data collected by FEFAC, industrial compound feed production within the EU27 is expected to decrease in 2024 by 0.3 % compared to 2023, to 147 million tons.

Poultry feed production is the only sector showing growth prospects in 2024, with an anticipated increase of 1.6%. This rebound follows a challenging 2023 driven by recovering poultry production in several key member states. Countries like France, Spain and Portugal, as well as Italy, already experienced some recovery from avian influenza impacts in 2023, and are expected to continue leading this growth. However, concerns about imported poultry meat and shifts from organic production towards standard conventional production may affect overall market dynamics.

The pig feed sector will face continued challenges, with a projected decline of app. 1-2% in 2024. Factors such as a decrease in the number of pigs and economic and disease pressures on farmers, including African swine fever, will continue to adversely impact production. However, Ireland and Poland expect a modest recovery (+3% & 2.7%) in pig numbers, contributing to a slowdown of the decrease of the sector’s output. Other countries like Germany, Belgium and The Netherlands refer to continued political pressure to reduce farm emissions or the scale of animal husbandry, resulting in a high level of uncertainty for the sector’s outlook.

Cattle feed production is expected to remain relatively stable, with minor growth or reduction depending on regional conditions. Ireland expects modest growth in cattle feed due to a delayed grazing season. Conversely, The Netherlands anticipates further decreases in dairy and beef sectors (app. -5%), driven by ongoing regulatory and environmental challenges.