Beef market update: production and trade in the first half of the year

Key points

• UK imports increased by 9% year-on-year, driven by competitive Irish product.

• Robust demand has absorbed year-to-date supplies, which stemmed from imports and higher kill numbers.

• H2 supplies are set to reduce, suggesting support for prices as the year progresses.

Trade

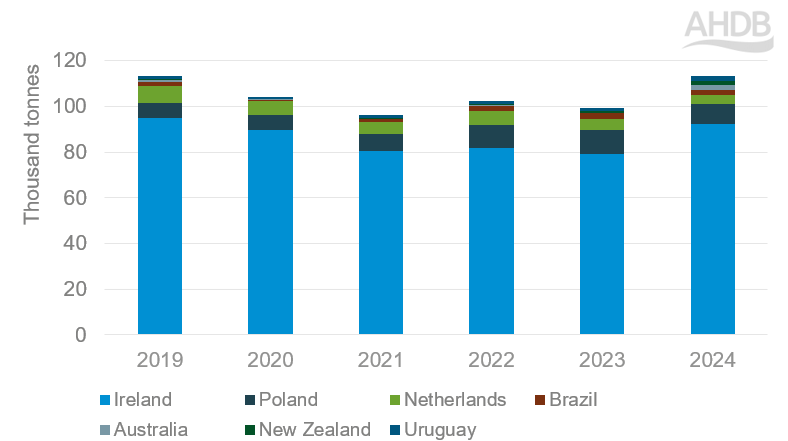

UK beef imports by country (YTD Jan-Jun)

Source: HMRC, compiled by Trade Data Monitor LLC

Year-to-date fresh/frozen beef imports (January to June) have totalled 120,199 tonnes, a 9.3% increase compared to the same period in 2023. This marks the highest import volume since 2019, supported by the firm domestic demand. Total fresh and frozen imports all saw increased volume, while total value saw a 12.8% uplift year-on-year (YoY). An increase in average value indicates that higher value cuts, such as steaks may have held a greater proportion of volumes.

As GB deadweight prices continue to climb, the extra product has been absorbed by high domestic demand. The latest 12 week ending 4th August GB retail datashows a 1.5% increase for beef volumes YoY. Additionally, shorter term market commentary suggests stronger demand in July, particularly for grilling products, as favourable weather encouraged BBQ occasions.

Irish beef, which accounts for 76.8% of beef import share, has driven the rise in imports, having increased by 16% compared to the same period in 2023. Competitive pricing and elevated kill numbers in Ireland supported this trade. Additionally, a significant price differential between GB and Irish steer prices has also contributed to high imports. As the price gap widens, an elevated import volume beyond June could be anticipated.

However, reports of tighter Irish supplies in the near future, consistent with our Irish beef market outlook projections could drive Irish prices higher.

Imports from Uruguay and Australia also increased in the first half of the year, but with a combined market share of just over 3%, the impact is currently limited. Meanwhile other players of similar share position; Poland, Brazil, and the Netherlands have imported less product to the UK. Increased production in the Southern Hemisphere, and growing price divergence with the Northern hemisphere raises pressure for a shift in trading partners.

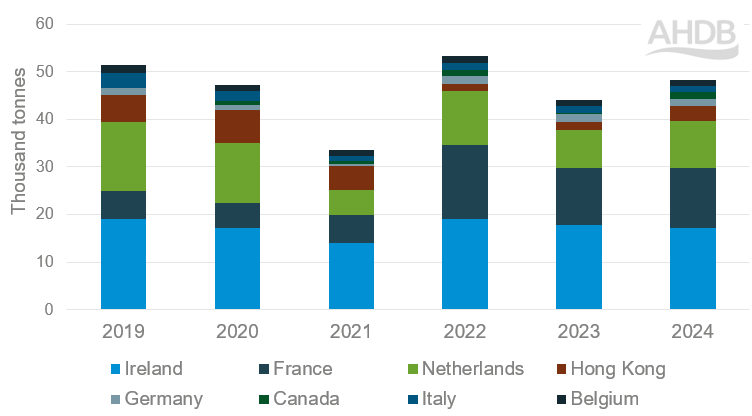

UK beef exports by country (YTD Jan-Jun)

Source: HMRC, compiled by Trade Data Monitor LLC

In terms of UK exports, tight European supplies have contributed towards favourable conditions. Year-to-date UK exports of beef (total fresh/frozen) increased by 11% vs 2023, driven by fresh product.

Again, exchange rates have implications and the recent weakening of the Euroagainst sterling making UK beef more price competitive in European markets.

Available supplies

Overall, the UK’s total beef supplies, taking into account production, imports and exports, have remained similar to the 5-year average.

According to Defra, year-to-date UK production has been at its highest level since 2020. Despite this, June supply has fallen from May and is lower than 2023 levels as sellers took advantage of the strong export market.

Beyond the first half of the year, July showed seasonally high levels of production, up by 10.5% YoY, but recent tight supplies have pushed prices higher.

The latest GB retail data for August saw further demand strength, with consistent demand for mince and recent purchasing of BBQ items, supporting the upward direction of prices. The trade implications for July will be closely monitored.

GB prices are expected to be supported towards the end of the year, as the tightening of GB kill numbers and lower supplies of Irish cattle start to influence the market. AHDB’s beef outlook expects lower supplies to persist into 2025.