Remarkable dynamics of the global poultry industry

Poultry meat production has seen tremendous growth in the last 50 years. It’s a wonder of agricultural development. Emeritus professor and statistical analyst Dr Hans-Wilhelm Windhorst witnessed it from the inside and reflects upon these remarkable dynamics.

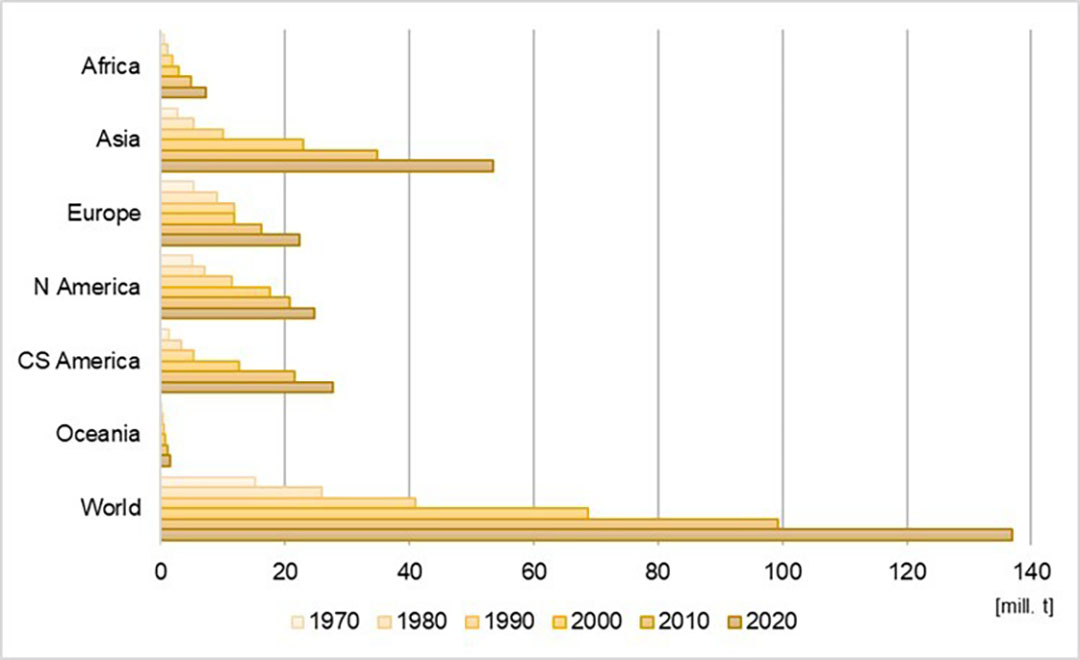

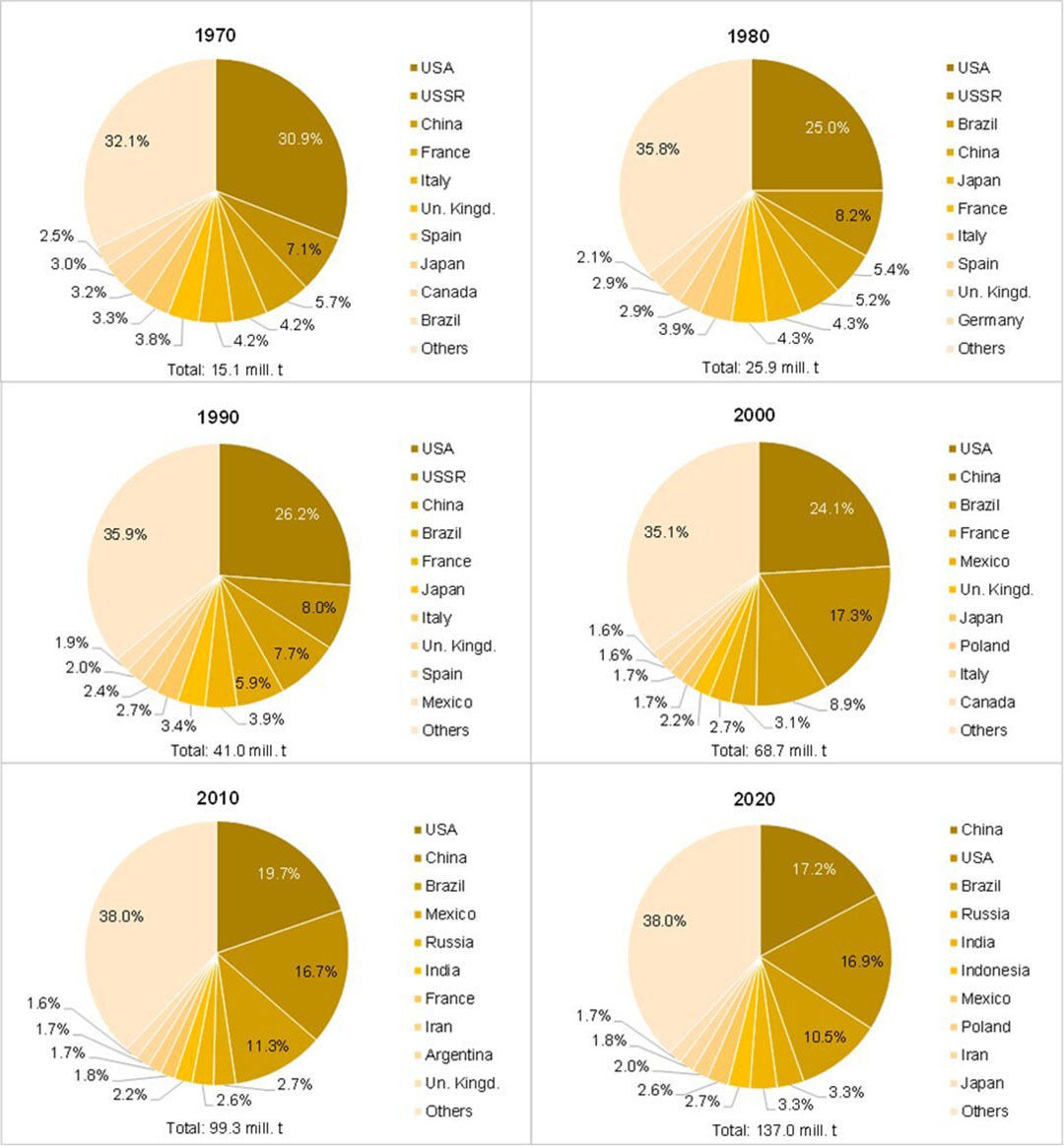

Between 1970 and 2020, global poultry meat production increased from 15.1 million tonnes to 137 million tonnes, or by 807.8%. It was by far the fastest-growing animal product. Production volume grew much faster from 2000 than in the previous decades. Between 2000 and 2020 it increased by over 68 million tonnes.

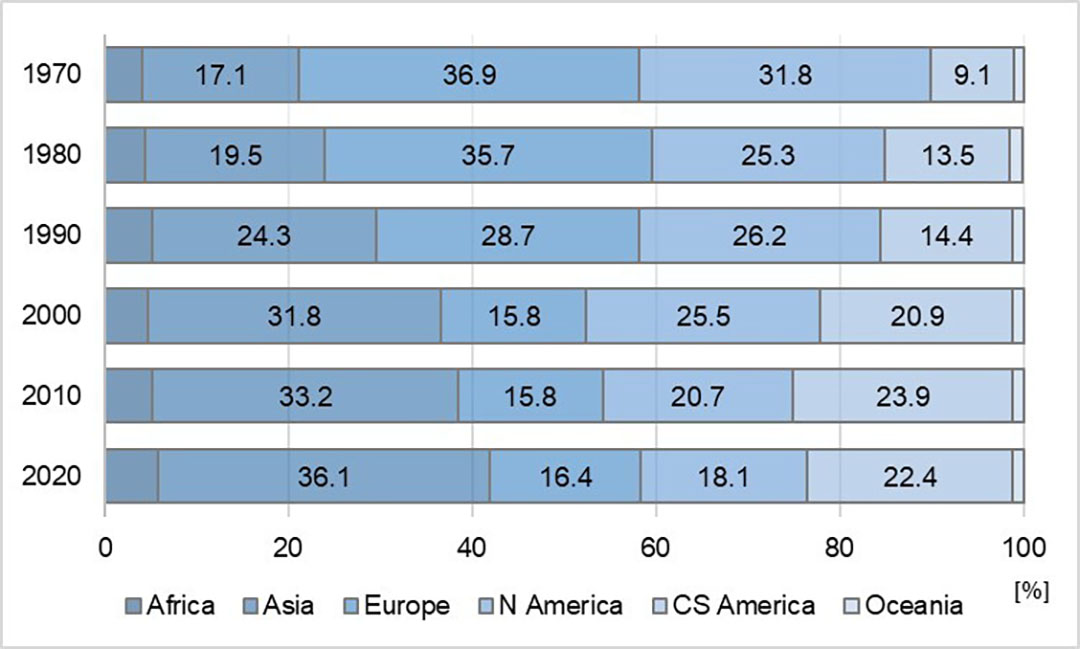

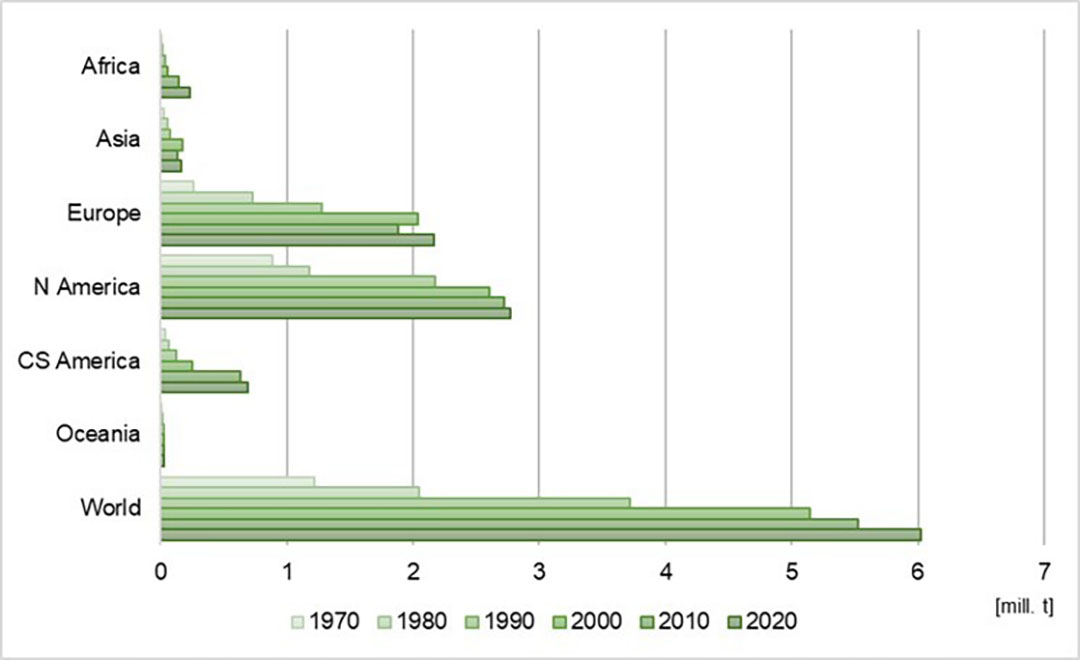

A detailed analysis of the development at continent level reveals the extraordinary role Asia played in the booming development (Table 1, Figure 1). To the absolute growth of 121.9 million tonnes in the decades under review, Asia contributed 41.6%, followed by Central and South America (16.8%), North America (16%) and Europe (14%). Africa and Oceania fell far behind. The highest relative growth showed Central and South America and Asia. Even in Africa, it was higher than in Europe and North America.

Europe ahead before the nineties

Until 1990, Europe produced more poultry meat than Asia; then the extraordinary growth in several Asian countries began, as will be documented in a later part of this article. In 2000, the Americas surpassed Europe. The different dynamics at continent level caused remarkable changes in the continents’ share in the global production volume.

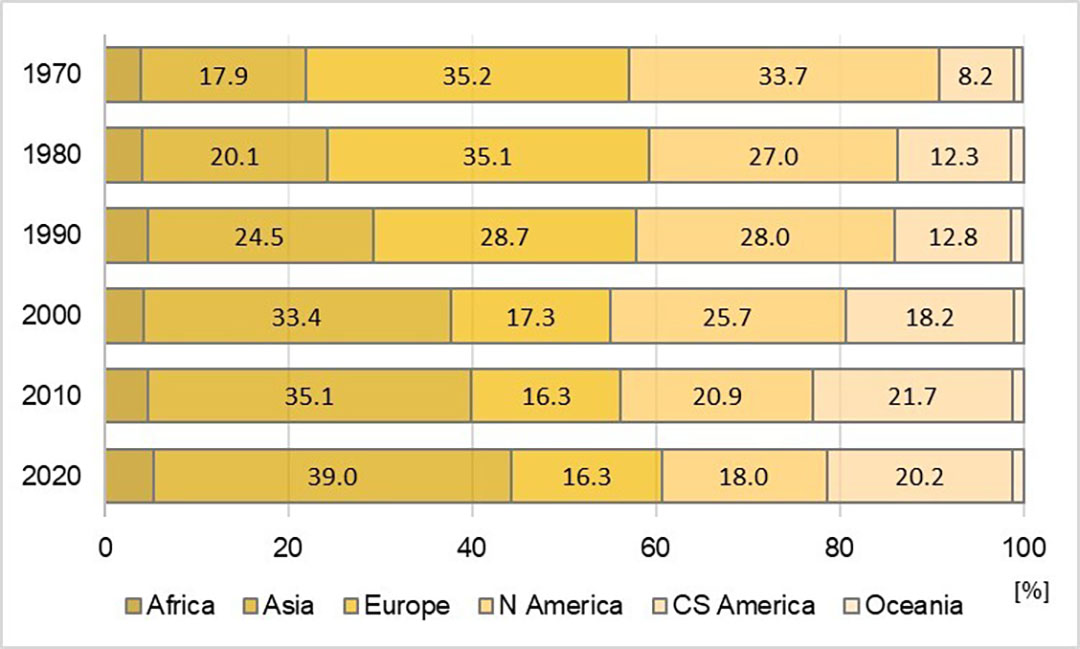

In the decades under review, Asia gained 21% while Central and South America 12%. In contrast, Europe lost almost 19% and North America more than 15%. These figures document a spatial shift of the regions with the highest dynamics from Europe and North America to Asia and Central and South America (Figure 2).

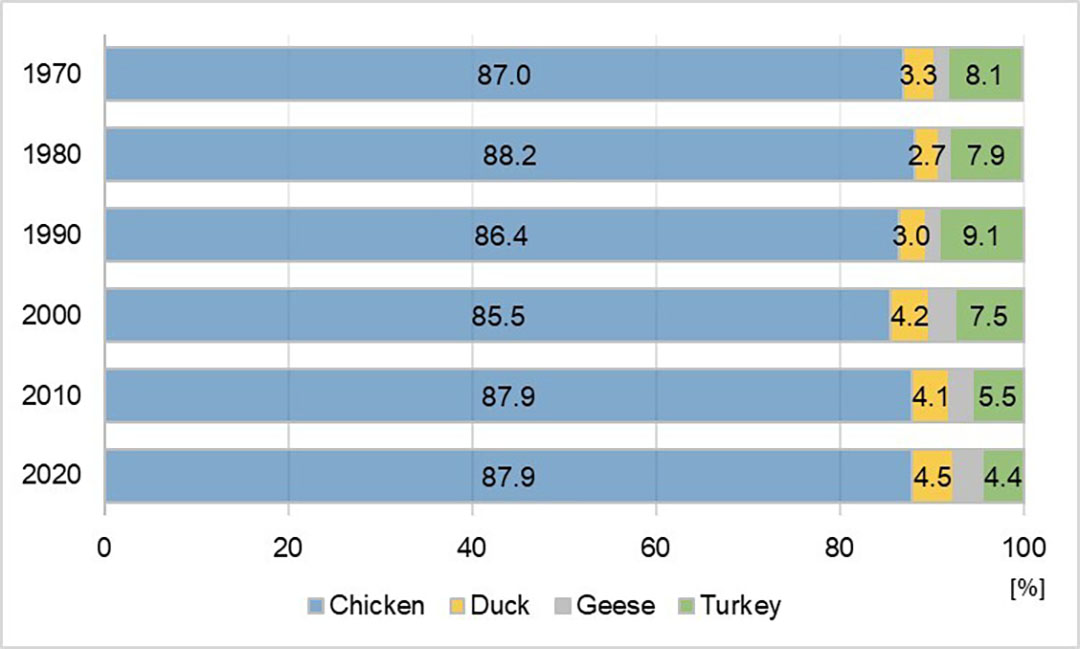

When breaking down the growth of poultry meat production by meat species, it is obvious that it was mainly a result of the extraordinary increase of chicken meat production (Table 2). To the absolute growth of the production volume, chicken meat contributed 108.3 million tonnes, or 88.1%. The highest relative growth rate showed, however, goose and duck meat. One can see that chicken meat shared between 85.5% and 88.2% in global production volume (Figure 3). While duck and goose meat were able to expand their shares, that of turkey meat fluctuated considerably.

Differences per continent

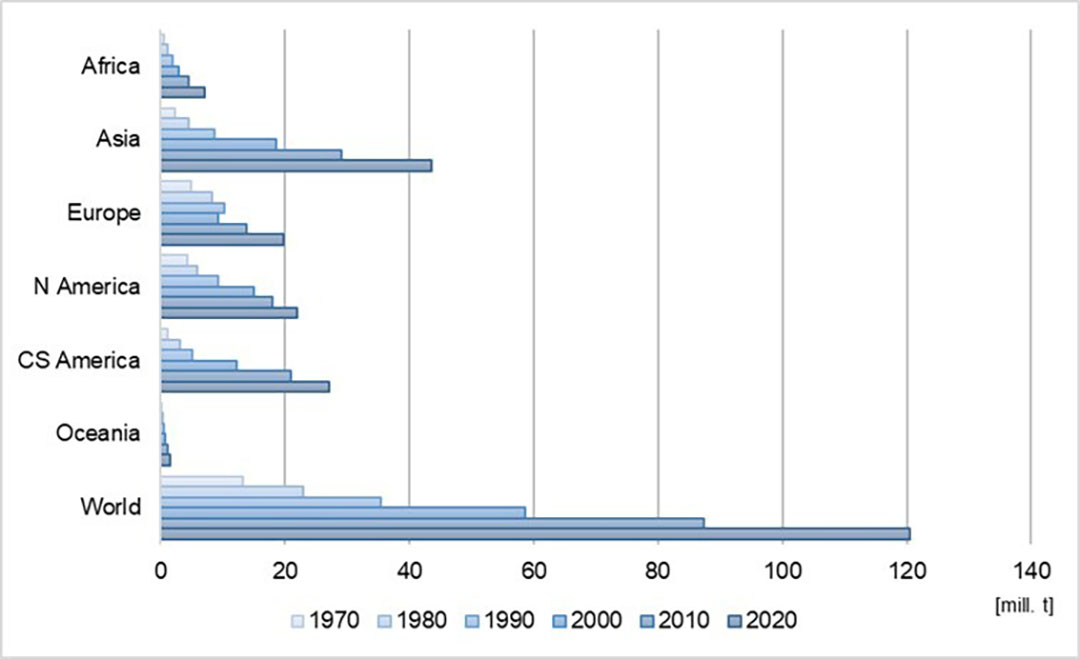

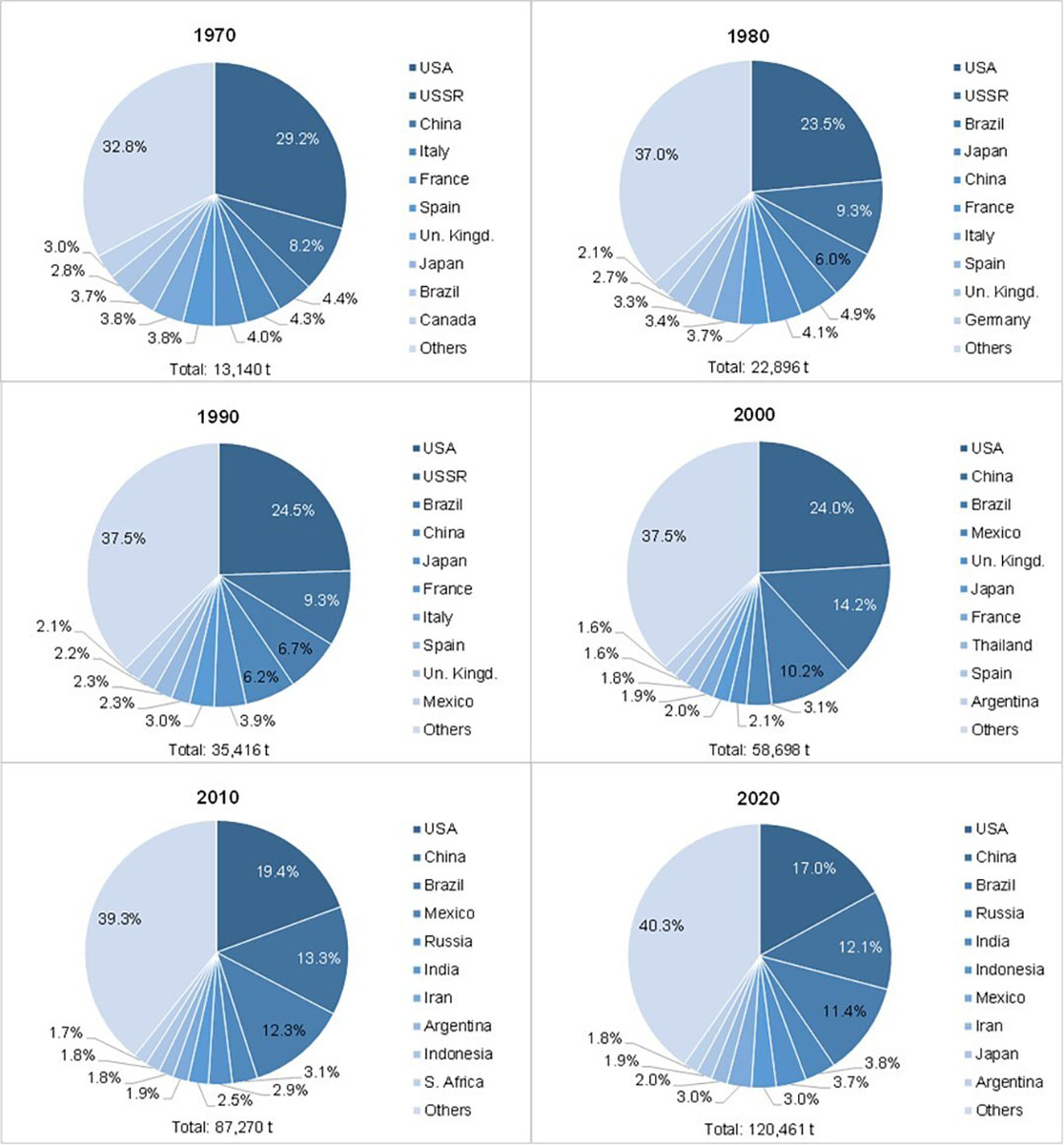

In a next step, the development of chicken and turkey meat production at continent level in the decades under review will be analysed separately. Figure 4 documents the dynamics in chicken meat production.

As expected, the dominance of this meat type resembles the dynamics for poultry meat. Because of the dominating role that Asian countries played in duck and goose meat production, the dominance of the continent was lower than in poultry meat in total. Until the 1990s, Europe and North America produced more chicken meat than Asia, and in 2020, Asia closed the gap in produced volume.

Figure 5 shows the changes in the contribution of the continents to global chicken meat production in the analysed time-period. A comparison with Figure 2 reveals that the shares of North America and Europe were similar while that of Asia was lower and that of Central and South America higher. A later part of the paper will show which countries caused the differences.

Chicken vs turkey

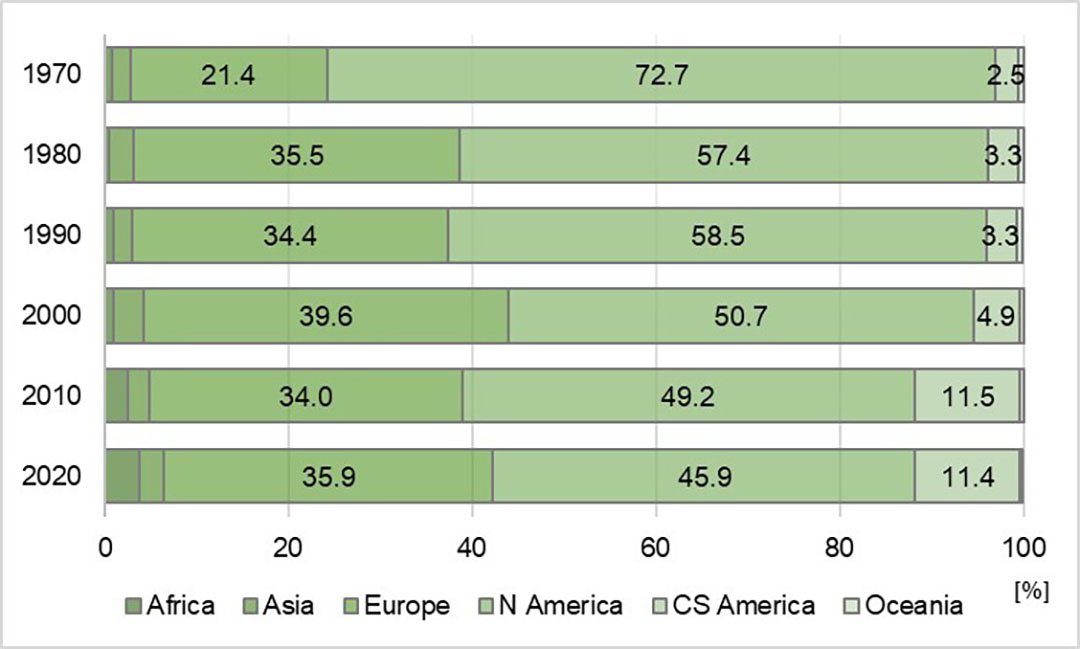

The dynamics in turkey meat production differed considerably from that in chicken meat production. Figure 6 shows that North America and Europe dominated the production of this meat type over the analysed decades. In all other continents, production volume was much lower and it was not before 2010 that Central and South America showed higher absolute growth rates.

When analysing the development over time, one can see that the absolute and relative growth rates were highest until the 1990s. From then on, they decreased and seem to have reached a plateau in the past decade. While North America and Europe almost contributed the same amount to absolute growth, the relative growth rates were highest in Africa and Central and South America.

The different dynamics changed the continents’ shares in global turkey meat production considerably (Figure 7). Between 1970 and 2020, Europe gained 14.4% and Central and South America 8.9%, in contrast, North America lost 26.8%. To the increase in the global production volume, Europe contributed 39.6% and North America 39.1%. The contribution of the other continents was much lower. This reflects the large differences in the per capita consumption of turkey meat. While this meat species is mainly consumed in Europe and North America, it has not reached a tradition as a meal in Asia and, with the exception of Algeria and Morocco, not in Africa.

Remarkable changes at country level

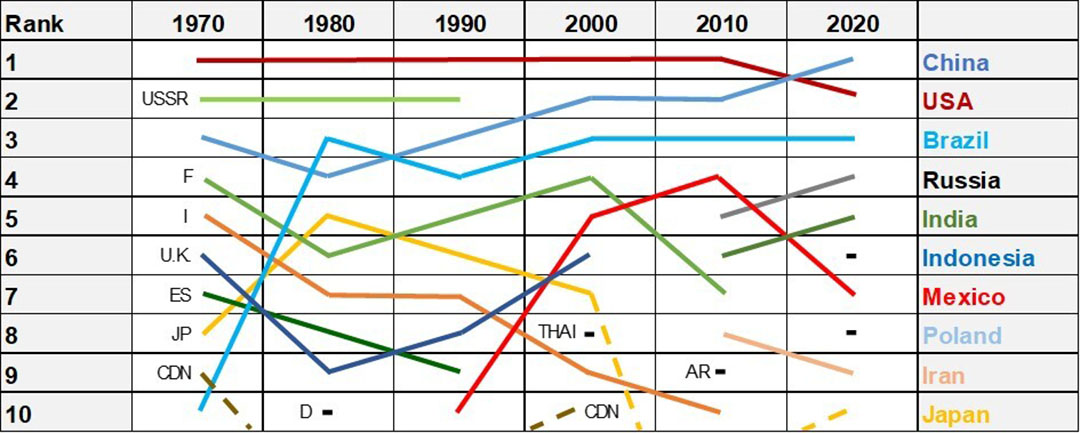

Over the past 50 years, the composition and ranking of the leading poultry meat producing countries changed considerably (Figure 8). The US ranked in first place until 2019. In 2020, they were surpassed by China, which in that year produced 442,000 tonnes more than the US.

An extraordinary dynamic development showed Brazil. It climbed from 10th place in 1970 to third place in 2020. Until 1990, the USSR held 2nd place. After the political and economic collapse, the production volume decreased dramatically and it was not before the past decade that the Russian Federation showed up in the top group again.

The drastic decrease of pig meat production, which resulted from massive outbreaks of African Swine Fever, initiated a dynamic expansion of broiler growing. While in 1970, 5 European countries ranked in the top 10 group, here the USSR is included, in 2020, only 2, the Russian Federation and Poland, reached high ranks. The composition of the 10 leading countries in 2020 reflects the already mentioned spatial shift. Five of the countries were located in Asia, 3 in the Americas and only 2 in Europe. Worth noting is the growing importance of India, Indonesia and Iran.

The regional concentration in poultry meat production was highest in 1970 when the 10 leading countries contributed 67.8%. In the following decades, their share fluctuated between 62% and 65%. Figure 9 documents the changes in the composition and ranking of the 10 leading countries. It reveals the declining importance of European and the growing importance of Asian and South American countries. With Poland, a European newcomer was, however, able to climb to 8th position in 2020.

With a few exceptions, the composition and ranking of the 10 leading countries in chicken meat production resembles that in poultry meat in total. In 2020, the US ranked before China in first place, producing about 6 million tonnes more than China. Argentina ranked in 10th place, substituting Poland.

Figure 10 shows the declining regional concentration in chicken meat production. While in 1970 the top 10 countries shared exactly 2-thirds in the global production volume, their contribution declined to 59.9% in 2020. This not only reflects the growing importance of Asian countries but also the general spatial spread of chicken meat production. The lack of religious barriers regarding consumption and the excellent feed conversion rate were the main steering factors behind this dynamics.

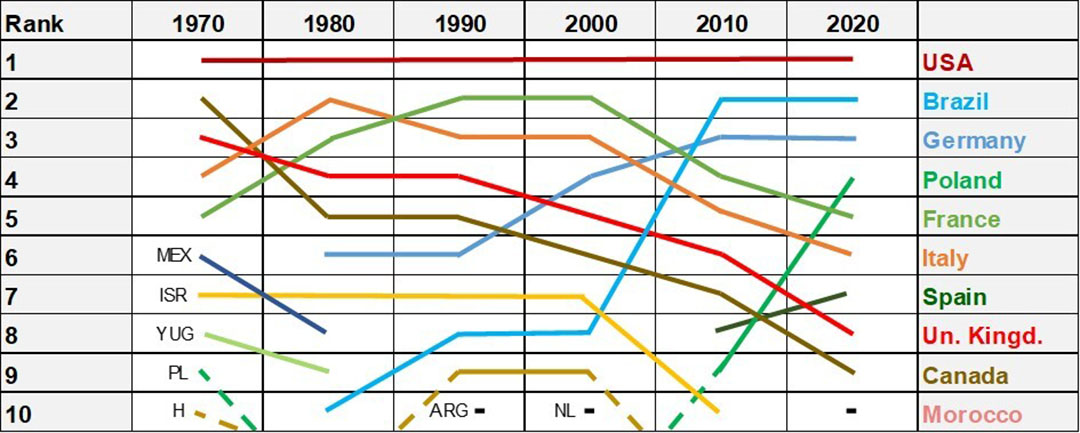

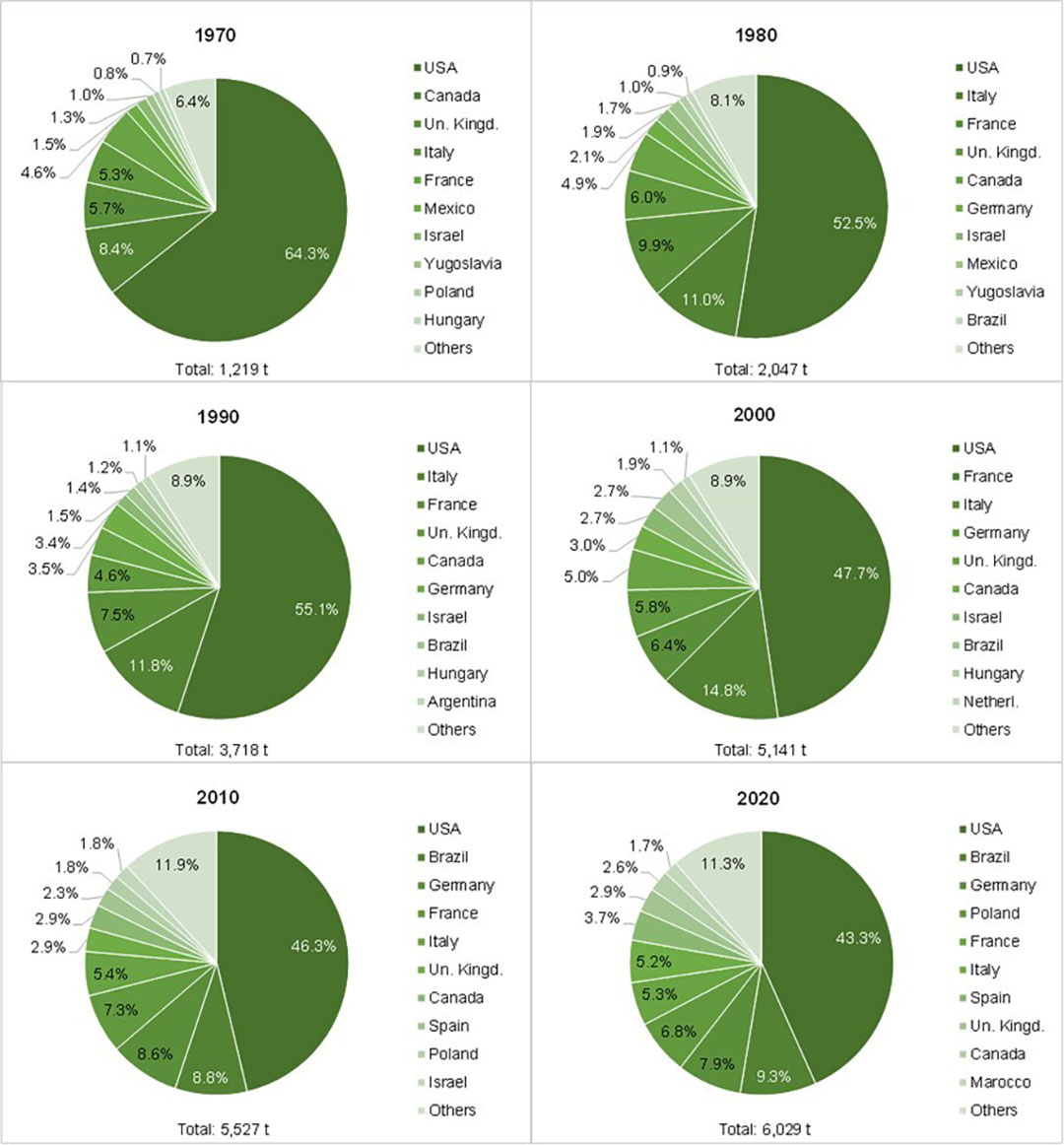

The composition and ranking of the leading turkey meat producing countries differed considerably from that of chicken meat. Figure 11 shows that European countries played a major role. In 1970 and 2020, 6 of the 10 leading countries were located in Europe. A detailed analysis of the dynamics in the ranking of the countries reveals some remarkable changes. The US ranked in first place during the decades under review. Brazil, which did not belong to the top countries in 1970, climbed from 10th to 2nd place in 2010 and could maintain that rank.

Similar dynamics showed Germany, which ranked 3rd in 2020. In contrast, Italy and France lost several places since 1980 and Canada as well as the UK plummeted from upper rankings to near the bottom. Poland and Spain became major turkey meat producers only in the course of the past decade. Israel ranked among the top producing countries from 1970 until 2010, but was then replaced by Morocco. Several countries belonged to the top group only for a short period, such as Yugoslavia, Hungary and Argentina.

As can be seen from Figure 12, the regional concentration in turkey meat production was much higher than in chicken meat. The fluctuation was also much smaller; it differed only between 88% in 2010 and 93.7% in 1970. In 1970, the US held a dominating position with a share of 64.3% in the global production volume. With the increasing production in Brazil and Germany, its contribution declined to 43.3% in 2020. The fact that the share of the 4 leading countries ranged between 83.7% in 1970 and 67.3% in 2020 documents the high regional concentration.

Despite the lack of religious barriers regarding the consumption of turkey meat, it never reached a double-digit percentage in the decades under review. The less favourable feed conversion and the frequent outbreaks of the avian influenza virus in turkey flocks in the US and in Europe also limited the growth of this meat species. In addition, the fact that turkey meat was not able to find its way into systems gastronomy and that it did not reach a similar position as broiler meat in Asian countries, explains the low growth rates respectively stagnation during the past 2 decades.

Summary and perspectives

The preceding analysis documented the extraordinary dynamics in poultry meat production over the past 50 years. In the decades under review, the production increased eightfold and reached a volume of nearly 122 million tonnes in 2020. Poultry meat was by far the fastest-growing animal product. This dynamic was mainly a result of the remarkable growth of chicken meat production, which shared between 85% and almost 88% in the overall production volume.

The application of the hybridization technology made the extraordinary success of chicken meat production possible. It reduced the days needed to grow a broiler to slaughter weight dramatically. In combination with a high-energy compound feed it reduced the production cost considerably and made broiler meat attractive for the consumers as the retail price was much lower than for beef or pork.

Worth noting is also that similar to the egg industry, production in most leading countries is organised in vertically integrated agribusiness companies. There is one difference however. While in the egg industry all steps of production are organised under one roof, in broiler and turkey production, contract growing became the standard form of operation, at least in market-oriented economies.

Turkey, duck and goose meat fell far behind and reached only single-digit percentages.

The dynamics in the continents and countries differed considerably, resulting in a drastic spatial shift. While the contribution of Asia grew from 23.8% in 1970 to 62.2% in 2020 and that of Central and South America from 8.2% to 20.2%, the shares of Europe and North America declined drastically. Europe lost nearly 30% and North America over 15% of their former shares.

The composition and ranking of the countries reflects the spatial dynamics. Even though the US was able to maintain its leading position in chicken meat, China and several other Asian countries (India, Indonesia, Iran) were the main winners beside Brazil in poultry meat production. European countries fell far behind. In 2020, only the Russian Federation and Poland ranked in the top group. The spatial patterns of turkey, duck and goose meat production differed considerably from that of chicken meat. Turkey meat was mainly produced in North America and Europe, duck and goose meat in Asia.ALSO READ: Remarkable dynamics of the global egg industry – part 1

In the OECD/FAO Agricultural Outlook until 2030, an increase of poultry meat production to 153 million tonnes is projected. Asia and Central and South America will strengthen their positions while North America and Europe will lose shares despite a growing production volume. Chicken meat will show the highest absolute growth, while duck and goose meat production will grow further in Asia. In contrast, turkey meat will show only a moderate growth, it may even decrease in North America and several European countries because of a falling per capita consumption.

In addition, the risk of massive avian influenza outbreaks in turkey flocks in North America and Europe may have incisive impacts. The current decade has shown that the avian influenza virus has become endemic in many countries of the northern hemisphere. A vaccination of turkeys and laying hens could reduce the risk of further epidemics, but a strong opposition against compulsory vaccination can be observed in several of the leading poultry meat exporting countries, because they fear negative impacts on their export opportunities.

Despite the success of plant-based meat alternatives and the beginning market approval of cultured meat, alternative meat products will only gain market shares in the single-digit percentage in the current decade. High production costs, problems in the scaling up of cultured meat production and an obvious scepticism against consuming the expensive and high tech products will limit the fast diffusion of alternative meat.